We wanted to send out a reminder that it's not too late to contribute to your IRA accounts for 2016 as long as you are still working and have not yet met your contribution limit. The IRS deadline for contributions is April 18, 2017. Please give us a call if you would like to make a contribution or have any questions.

Asset Planning, Inc Blog

We talk to clients everyday about how important estate planning is and how they should have a trust in place to ensure that their wishes are met after they pass away or become incapacitated. While having a trust set up is great it doesn’t really provide all of the details necessary for a spouse or loved one to take care of the day to day tasks of wrapping up your affairs. It is a really good idea to create an information folder that provides the pertinent details such as account numbers and passwords. This is also valuable to have in case of an emergency such as a car accident or house fire. You can grab this folder and go. Here is a list of information you should have in the folder.

• Assets: checking and investment accounts, private business interests, location of safety deposit boxes, annuities, individual retirement accounts and 401(k)s, trust agreements, real estate, vehicles, collectibles

• Liabilities: credit cards, mortgages, car payments, cell phone bills, other recurring bills • Social media/online accounts: passwords and login information for Facebook, Twitter, Instagram, Pinterest, LinkedIn, Amazon, PayPal, eBay, Netflix, Hulu, iCloud or other cloud storage accounts, online photo storage accounts

• Miscellaneous subscriptions/memberships: airline rewards programs, Sam’s, BJ’s or Costco memberships, toll tag accounts, magazines, newspapers • Insurance: life insurance, long-term care, disability, home, auto

• Home maintenance: water, gas, electricity, telephone, alarm, lawn care, cable television, Internet service • Medical: medical conditions, medications, emergency contacts

• Personal: burial/cremation preferences, funeral plans, pre-paid funeral expenses, birth certificates, marriage certificates, Social Security card

• Key contacts: financial and legal advisors, doctors, family members, close friends

Each person’s folder will require different information but this is a good start and you can customize it as needed. It also may be a good idea to keep a copy of this information in a folder in your email account, that way you only need to have one password to give out and everything is backed up by the cloud.

(This list was compiled from an article on wealthmanagement.com)

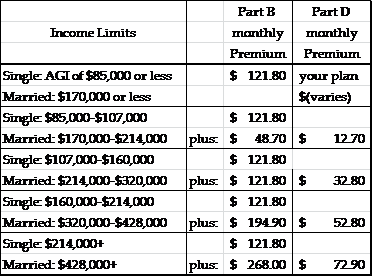

The law requires an increase to your monthly Medicare Part B & D premiums if you have “higher Income”. The higher your income, the more you pay. Most people do not pay the higher premium but we want you to be aware that this might happen if you sell a home or stocks with large capital gains or take large distributions from your IRA accounts because it will increase your AGI. Your 2017 Medicare premium will be based on your Adjustable Gross Income (AGI) from your 2015 tax return. Each year the premium is re-evaluated based on your taxes. If you have a large windfall in one year you will only have to pay the increase for one year and then the premium will go back down.

The following is a table that shows the income amounts that were used in 2016:

The Social Security cost of living increase and Medicare premium increase have not been announced yet but is expected to be less than 1%. The open enrollment period to change your Medicare plan is from October 15-December 7.

It is also that time of year for Open Enrollment if you are employed with benefits. Make sure you review all the benefit options you have and choose what is right for you. Take advantage of Flexible Savings accounts for healthcare or childcare. Has your income increased – did you also increase your 401K contributions?

Note: You can dispute the increase if your income has decreased substantially. The number one reason is due to death of spouse or divorce. The Medicare website has a list of what reasons are acceptable and what you need to do to dispute the increase.

Even if you are not super wealthy there are many benefits to setting up a living trust. A living trust is a document set up by an estate attorney to help you manage your assets, including property while you are alive and names a trustee to act on your behalf to carry out your instructions, if you become incapable of caring for yourself or pass away. Here are a few of the top reasons why you should set up a trust.

Avoids Probate- A trust allows your heirs to bypass probate which can be a lengthy process and your estate can be charged up to 5% in probate fees. This can mean a substantial savings in time, legal fees and paperwork.

Protection Against Disputes- Unfortunately there may be someone who is unhappy with the way you have instructed to have your assets distributed. A trust is harder to contest than a will is because they have to be able to prove that you were under undue pressure or influence in setting up the trust which is nearly impossible.

Flexibility- Trusts offer more flexibility in how you can distribute the funds. In the case where you may have minor children you can specify how the money is spent and when they would have full rights to the funds.

Avoids Estate Taxes- A trust can provide a way to avoid or reduce estate taxes because assets and property placed into a trust are not subject to these taxes.

Minimizes Family Conflicts- You can specifically detail exact items and monetary distributions to be given to each beneficiary. This helps to curtail any of the “who gets what” problems that may arise with family members.

Privacy- Trusts, unlike wills, are private because they do not go through probate. This means your assets and who you leave them to are kept private.

Auto insurance is pretty much a no brainer. It’s required by law to have so you get a policy and pay your premiums, end of story right? Well, it shouldn’t be. The average person buys a policy and doesn’t think about it again. It is really important, however, to do a periodic check up on your auto insurance policy to make sure you are covered adequately and are receiving all of the discounts you are entitled to. Many changes occur over the years in life like getting married, buying a house, and having a baby. Your auto insurance needs change over the years as well. Having the same coverage limits you did when you were first on your own may not be enough to cover your assets if you were sued in an automobile accident. Talk to your insurance agent to ensure that you have enough liability coverage. Another good thing to do is ask your agent if you are receiving all of the discounts that you are entitled to. There are a ton of discounts available and they may not necessarily be applied to your policy. Some examples of these discounts are good student discount, defensive driver discount, multi-policy discount, mature driver discount and the list goes on. Many of these discounts are not automatically added to your policy so it does not hurt to ask what discounts your insurance company offers. Next, get a few different quotes from other reputable companies for the same coverage that you have. This will give you a good idea if you are paying too much and may give you incentive to switch. By just taking a few extra steps to review your policy each year you could save enough each month to fill up your gas tank.

Everybody knows how important maintaining a good credit score is. Having a good credit score will get you better interest rates on home mortgages, car loans and credit cards. Landlords and even employers are looking at this number when making decisions to rent/lease to you or hire you. With credit being such an important factor in life it’s crucial that you know what your credit score is and checking your own credit score does not impact your credit. Luckily for you there are many new and free credit monitoring services out there to help you do just that. So if your credit needs a little help, don’t despair, check out these free tools to help guide you on the path to great credit!

Creditscorecard.com

Creditsesame.com

Creditkarma.com

If you choose to sign up for one of these websites they will ask you for personal information to identify yourself to verify that it is in fact you signing up. These websites are all free monitoring services and they will not ask you for any credit card information. They will however send you marketing materials with offers based on your personal information. It seems like a small price to pay in order to be able to monitor and take control of your own credit. Good luck on your journey to overall better credit health!

We recently came across an article written by Kraig Mathias with some great money saving tips and want to pass them along to you. By following these tips you can really help your bottom line and focus your extra funds towards saving for the future.

- Get out of debt and stop borrowing money. Pay off all of your debt now and do not buy more than you can afford to pay off each month. Having no more payments means you can save that money instead.

- Stop going shopping. While you are getting out of debt stop spending money on unnecessary stuff. You will not make any progress if you continue to spend money at the same time you are trying to pay off your credit cards. It is a vicious cycle that is hard to get out of.

- Eat at home and eat out very little. Eating out can be extremely expensive. You will be amazed at the amount of money you can save by merely eating at home more often.

- Make a budget each month. Once you sit down and make a budget for the month you will be able to see where all of your money is going and can cut out unnecessary spending.

- Think about the bigger picture. Set a goal for why you are saving your money. Once you have a specific goal it will be easier to say no to that daily cup of coffee at Starbucks and make one at home.

- Downgrade your disposable goods. You can save big time by buying the generic laundry soap instead of the name brands. They are usually just as good without the high price tag.

- Keep your living situation modest. If you are serious about saving money living in a posh apartment or driving that expensive sports car is going to put a strain on your savings potential.

- Learn to say no. You’ll have to learn to say no to an expensive night out with your friends. Try suggesting a low cost alternative. This is a big part in taking control of your discretionary spending.

- Learn to be content with what you have. If you are content with what you have you will be less likely to want more. Instead of going out and buying new stuff all of the time, try saving for it and paying in cash instead of charging it. You will be more satisfied with the purchase and that you earned the new item.

As soon as I finish my taxes I also do some spring cleaning of my paperwork clutter and finances. Here are some tips to get your financial house in shape:

-

Organize financial papers: Do not leave financial documents around that contain information that could be used to steal your identity. Shred paperwork you no longer need. Save important papers in a secure place and if possible, digitally (scan and save on external drive/usb, etc.) and secure with a password.

-

Bills, paystubs, bank and investment statements should be kept for one year and then just keep the year end summaries and shred the rest.

-

Keep invoices and all bills for major repairs, improvements and construction on your home. This is vital to have when and if you ever sell your home for increased cost basis.

-

Tax returns and all supporting documentation should be kept for at least 7 years. A good rule is to scan your older tax returns and keep them forever.

-

Run your credit report to see if there are any unusual transactions. Annualcreditreport.com allows one free report per agency per year.

-

Automate adding to investments and savings.

-

Adjust tax withholdings on your income (paycheck, IRA’s, etc.) if you owed too much tax or received a large refund.

More and more people have been using credit cards when they travel abroad, and although there are many benefits to using them, they sometimes come with hidden disadvantages. The key to using a credit card abroad is being smart. Knowing which card to use and when to use it can save money and trouble. More and more people are experiencing problems with their cards, so in order to save you the hassle, we have provided you with the following tips to use while traveling abroad with your credit card.

Call your credit card company: Credit card companies sometimes freeze accounts if they see transactions taking place in a foreign country, so before you go on vacation, make sure to call to inform them of your trip. Giving them this information also serves as extra fraud prevention, as they can see if any transactions have been made from places not included in your itinerary.

Check for foreign transaction fees: Credit cards can be much easier to use than cash when traveling, especially if your destination uses a different currency. Before using your credit cards, check to see if the company has a foreign transaction fee. It’s important to find out about these fees before using your card because they can be as high as 3%. Some credit cards that do not have foreign transaction fees include the Chase Sapphire Preferred Card, the Capital One Quicksilver Cash Rewards Credit Card, and the BankAmericard Travel Credit Card. Also, be aware that some companies charge this fee even when you visit countries that use the U.S. dollar.

Look into getting an EMV: EMV’s (Smart Cards) are credit cards that provide extra fraud prevention. These cards have a chip, special magnetic strips, and a pin that make it almost impossible to hack. These types of credit cards are highly used in Europe, and some ATM’s and kiosks only accept EMV’s. Some companies that provide smart cards to the U.S. are Bank of America, Chase, Citi, U.S. Bank, and Wells Fargo.

Call for local customs: Before going on a trip, it is a smart idea to call a hotel to ask what the customs of the region are. For example, there are some countries in which the taxi drivers and guided tours only accept cash. Calling ahead of time allows you to plan how much cash to bring.

Be Prepared: It is smart to bring other forms of payment as back up. Bringing other credit and debit cards, and bringing extra cash are never a bad idea. Also, write down the credit card company’s information so that you can contact them as soon as possible if something occurs.

Traveling abroad should be a fun and enjoyable experience, but before leaving on a trip, remember that it is important to be safe and smart. Here are a few quick tips that can help keep you informed and aware when traveling.

Check Security Advisories: Safety should be the top priority, especially when traveling abroad. Before leaving the country, you should check the security advisories regarding any countries that you may be visiting. These advisories, which you can find on various government websites such as http://www.travel.state.gov/content/travel/english.html, are a great way to get informed about any possible threats that you might encounter.

Add Google Alerts: One easy way to stay up-to-date with all the latest news is google alerts. Google alerts give you the latest information on industries, locations, and people through email. Getting access to these alerts is fast and simple. Once you log into your google account, search “alerts”. This page will provide you with the latest trends and the option to search and sign up for the alerts that you choose.

Use Social Media: Social media is one of the best ways to stay informed with the latest information. Before you travel, it is a good idea to follow the Twitter accounts of organizations and groups that belong to the country or countries you will be visiting.

Carry your Passport: When you travel abroad, it is wise to carry your passport with you at all times because it provides others proof of your identity. Although it is smart to always travel with your passport, it is important to remember to keep it in a safe place. To avoid having it stolen, make sure you keep it close to your body. Putting it in a pocket or purse is not recommended, as those locations can be easy targets for thieves. Also, know where the nearest embassy is located in case of an emergency.