This year, large capital gains on mutual funds are expected. Usually when the market performs very well, higher capital gain distributions can be predicted. Capital gains are created through buy and sell activity during the year within the mutual fund's holdings. That activity creates capital gains which must be paid out to the mutual fund holders. Capital gain distributions are generally paid once a calendar year, usually in December.

For example, if you own mutual fund XYZ, and the fund holds Amazon stock at a gain and the fund manager needs to trim some of the Amazon holding, this will produce a capital gain. Your portion of the gain will be distributed to you as cash or shares reinvested. Often, fund managers start selling and buying in the portfolio to rebalance the fund.

Overall, these gains are good as they are either paid in cash or reinvested and you get more shares. However, if it is held in a taxable account, there will be taxes owed on the gain unless there are losses that can be netted. If the funds are in a qualified, tax deferred account such as an IRA or 401(k), your capital gains distributions will have no taxable impact.

You will notice many daily fluctuations. When the gain is paid, the fund will drop in value by the same percentage as the gain paid. The next day, the value of the fund will rebound.

Asset Planning advisors will be monitoring the gains and using tax loss harvesting to offset the tax liability as much as possible, if any.

If the shares were held over one year: you owe taxes at the lower, more favorable capital gains rate (0%, 15%, or 20% depending on your income tax bracket).

If the shares were held for less than one year: you owe the short-term capital gains rate which is the same as your marginal tax rate (10%, 12%, 22%, 24%, 32%, 35%, or 37% depending on your income tax bracket).

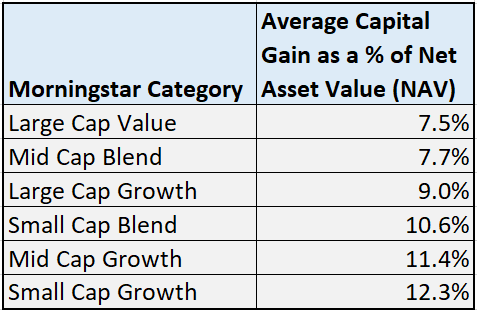

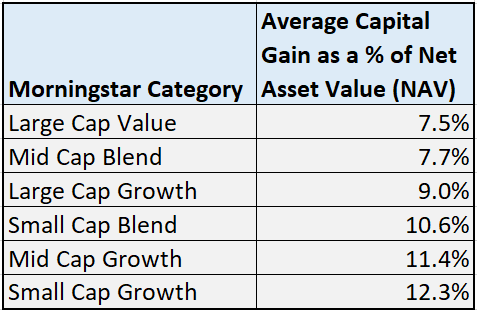

Please refer to the table for the average capital gain expected for the different Morningstar fund categories.