As you know, all of us at Asset Planning put our clients personal and financial well-being as our number one priority. One of the ways we do this is by keeping you updated on any potential dangers when it comes to fraud and scams that we hear about. While doing research on a scam we were alerted to, I came across the Federal Trade Commission website. Along with many other self-help topics, there are two sections dedicated to privacy, identity & online security and scams. There you can find useful tips and recent information on scams going around. I found this website to be a useful tool in my research and I was even able to sign up for email notifications to alert me to any new scams they have been notified of. If you are interested in keeping up with the latest news on these sorts of things click on this link and sign up for email updates.

Asset Planning, Inc Blog

It’s a known fact that people are living a lot longer than they used to. Do you have a plan in place for your aging parents? I came across an interesting article in Financial Advisor Magazine about the toll being a care taker for your aging parents can put on you financially and emotionally. If you are facing the prospect of being the caretaker for your parents as they get older, the time is now to start having the important conversations with your family about getting an action plan together for their care.

Click here to read the full article

There is now a whole section of Flexible Spending Account eligible items available on Amazon. In case you don't know what an FSA is, it is an account that you put pre-tax money into that you use to pay out-of-pocket health care costs with. The limit per person each year is $2,650 and most plans require that you use up that amount each year. Even though there is a limit of $2,650 a year you are not required to contribute that much. You can estimate what you think you spend per year and only contribute that amount. People use their FSA accounts to pay for copays, deductibles and prescriptions but there is a lot of over the counter products that meet the eligibility requirements ranging from blood pressure testers all the way to sunscreen and lotion.

Most of the time FSA owners will pay for these out of pocket expenses and then submit a claim form to be reimbursed but there is another option. You can now request a debit card for your FSA and pay directly for these expenses using that card. If you would like to order from Amazon, you would enter your FSA credit card information and select that card as your form of payment. When I was looking on Amazon I simply searched for FSA eligible items and was amazed at all of the products that were available and that I would be able to use for my family on a daily basis. This is a great way to use up the funds in your FSA account.

If you do not have a Flexible Spending Account, it may be something to look into. Not all employers offer them, but it doesn't hurt to ask your human resources department. Remember whatever you do contribute will reduce your taxable income because the contributions are made pre-tax. It's really a great way to pay for your out-of-pocket health care costs.

When googling FSA eligible products, I noticed that there were a lot of other stores that offer them as well. I just love the convenience and delivery options of Amazon, especially if you're a Prime member.

We came across an article on InvestmentNews.com written by Mary Beth Franklin. It gives a great explanation as well as examples and limits on how Social Security benefits are taxed if you are planning on working while collecting social security. Definitely worth a read if you have any income from other sources while collecting Social Security.

Click here to read the full article

2019 annual contribution limits for eligible tax filers:

401(k), 403(b), most 457 plans, and Thrift Savings Plan is increased from $18,500 to $19,000.

IRA contributions increased from $5,500 to $6,000 per year. The age 50+ catch-up contribution limit remains at $1,000.

Tax deduction and Income limitations for 2019:

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or their spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. (If neither the taxpayer nor their spouse is covered by a retirement plan at work, the phase-outs of the deduction do not apply.) Here are the phase-out ranges for 2019:

If single or joint married taxpayers are not covered by a work retirement plan, they may fully deduct traditional IRA contributions. Other tax filers may partially or fully deduct contributions if they meet the below exceptions:

- Single taxpayers covered by a work retirement plan, can fully deduct if modified Adjusted Gross Income (AGI) is below $64,000. A partial deduction is allowed if modified AGI is between $64,000 to $74,000

- Married Joint taxpayers, where the spouse making the IRA contribution is covered by a workplace retirement plan, can fully deduct if modified AGI is below $103,000. A partial deduction is allowed if modified AGI is between $103,000 to $123,000

- Married Joint taxpayers, where the spouse making the IRA contribution is not covered by a workplace retirement plan, but the other spouse is, can fully deduct if modified AGI is below $193,000. A partial deduction is allowed if modified AGI is between $193,000 to $203,000

The Modified AGI phase-out range for Roth IRA contributions is $122,000 to $137,000 for singles and heads of household, $193,000-203,000 for married couples filing jointly.

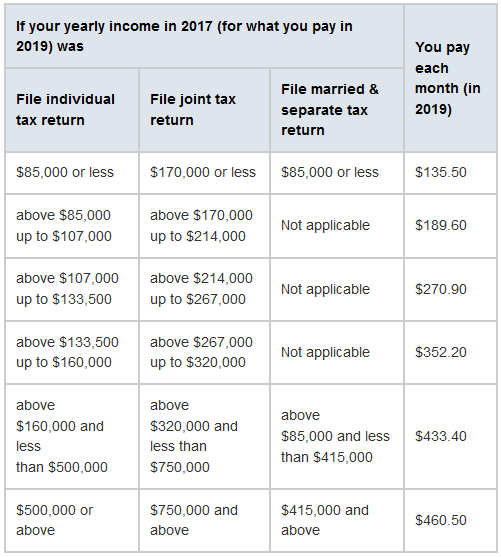

Medicare just released the new premiums, deductibles and coinsurance amounts for 2019.

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018.

The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018.

If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA)

Here is a chart for reference

Social Security announced that in 2019 there will be a 2.8% Cost of Living Adjustment(COLA).

President Trump issued an executive order directing the Treasury Department to extend the age for required minimum distributions from retirement accounts. Currently the age is 70 1/2. His reasoning is that people are working and living longer. This can be good news for some of our clients who don't necessarily need to take the withdrawals at 70 1/2. Here is an articles from Forbes with some pros and cons to the proposed change.

We've come to the realization that not everyone knows what gap insurance is and why it may be a good idea to get it when purchasing a brand new car. Gap insurance is an insurance policy you buy to cover the amount your insurance company will pay out vs. the amount you owe on your car loan, in the case of an accident where your car is totaled. This is an important coverage to consider especially if you are purchasing a brand new car. Car values drop drastically once you drive the vehicle off the lot. By not purchasing the gap insurance you run the risk of owing a lot more than what the car is worth after an insurance payout. That means you would either have to pay off the loan balance yourself or roll it into another vehicle loan which would most likely leave you upside down. Definitely not a good place to be in. Here is an article, written by Joshua Caucutt from Money Crashers, that goes into further detail about gap insurance, how to get it and helps you decide if you need it.

https://www.moneycrashers.com/gap-insurance-cars-worth-it/

Have a great weekend!

Melani

The deadline for getting your 2017 IRA contributions to us is Wednesday, April 11th. Tax season is an extremely busy time so the sooner you get these in the better. Feel free to stop by the office anytime from 8am-4pm to drop them off.

Have a great weekend!

Melani

Even though tax season is is behind us you may still be going through important documents or filing them away. We thought now was a good time to let you know that we offer free document back up for our clients. We will take your important documents, scan them, keep them in your electronic client file here and also save them to a password protected flash drive for you to keep. We're always sending out reminders of the importance of having your documents in a safe place and backed up in case of a fire or other emergency and now it's easier than ever to get it done with this free service.

Examples of items you may want to have scanned are; birth certificates, medical records, insurance policies, bank and investment account information, identification cards etc.

Having this USB drive with you while traveling could be especially useful if there is an emergency while you're away from home.

If you would like to take advantage of this offer, feel free to give me a call to set up a time to drop your documents off.

Have a great weekend!

Melani