Our offices will be closed on Monday, December 26th. We will resume normal business hours on Tuesday, December 27th.

Our offices will be closed on Monday, December 26th. We will resume normal business hours on Tuesday, December 27th.

Our offices will be closed Thursday, 11/24 and Friday, 11/25. Normal business hours will resume on Monday, 11/28.

From all of us at API, we would like to wish you and yours a very Happy Thanksgiving!

We are elated to announce that Samantha has passed her CERTIFIED FINANCIAL PLANNER™ exam! We would like to congratulate her on this huge accomplishment as well as acknowledge all of the hard work she has put into studying for this exam and just know that she is going to do well. Once she receives her official certification we will have 4 CERTIFIED FINANCIAL PLANNERS™ in the office to help with your financial planning needs.

Happy Veterans Day!

“We don’t know them all but we owe them all.” — Anonymous

Asset Planning, Inc. now has reserved parking spots for our clients. They are located near the building's back entrance and have "Reserved for API/H+B" painted on them.

Please feel free to use them next time you come see us!

The Social Security Administration announced this week that there will be a Cost of Living Adjustment (COLA) for Social Security and Supplemental Security Income (SSI) benefits for more than 65 million Americans. The increase will be 0.3 percent and will start in January 2017. The intention of the increase is to help offset the rising cost of living for seniors.

Medicare premiums for 2017 have still not been announced. We will keep you posted as soon as they are.

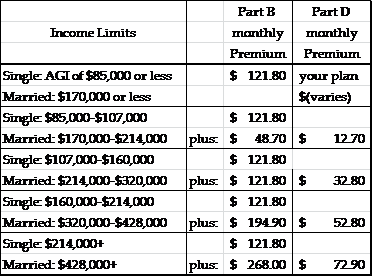

The law requires an increase to your monthly Medicare Part B & D premiums if you have “higher Income”. The higher your income, the more you pay. Most people do not pay the higher premium but we want you to be aware that this might happen if you sell a home or stocks with large capital gains or take large distributions from your IRA accounts because it will increase your AGI. Your 2017 Medicare premium will be based on your Adjustable Gross Income (AGI) from your 2015 tax return. Each year the premium is re-evaluated based on your taxes. If you have a large windfall in one year you will only have to pay the increase for one year and then the premium will go back down.

The following is a table that shows the income amounts that were used in 2016:

The Social Security cost of living increase and Medicare premium increase have not been announced yet but is expected to be less than 1%. The open enrollment period to change your Medicare plan is from October 15-December 7.

It is also that time of year for Open Enrollment if you are employed with benefits. Make sure you review all the benefit options you have and choose what is right for you. Take advantage of Flexible Savings accounts for healthcare or childcare. Has your income increased – did you also increase your 401K contributions?

Note: You can dispute the increase if your income has decreased substantially. The number one reason is due to death of spouse or divorce. The Medicare website has a list of what reasons are acceptable and what you need to do to dispute the increase.

The shocking news that Wells Fargo employees opened 1.5 million unauthorized accounts and 565,000 credit cards has caused concern for Wells Fargo customers everywhere. Wells Fargo has said that they will be contacting customers who they feel may have had accounts wrongfully opened and invite their customers to come into a branch to do a review with a banker. We feel however that it is good to be proactive and instead of waiting for a call, do a little research on your own to protect yourself. Here are some steps you should take if you are worried that you may be a victim of fraudulent activity.

Check your accounts- Look at your Wells Fargo online account, call Wells Fargo or go into a branch to review any accounts in your name. Make sure that you authorized any accounts that were opened in your name. Also, look through each account for any unusual fees or unauthorized money transfers. Wells Fargo has been accused of charging illegal fees on student loans as well as making unauthorized money transfers between accounts that may have caused insufficient funds charges.

Check your credit report- If you haven’t checked your credit report recently you should check it now. You can get a free credit report every year at https://www.annualcreditreport.com/ Look for any unauthorized accounts opened in your name or any unauthorized credit inquiries made by Wells Fargo. If a credit card was opened without your knowledge and there were fees that you were unaware of and were unpaid those may also have been reported to the credit agencies. If you find any discrepancies contact Wells Fargo immediately as well as the credit reporting agencies (Experian, Transunion, Equifax) to dispute the fraudulent activity and have it removed from your report.

If you are unable to have the issue resolved through the bank or credit agencies you can also submit a claim with the Consumer Finance Protection Bureau by calling 855-411-2372 or online @ http://www.consumerfinance.gov/complaint/ .

Sandy was invited to speak at The Advisors in Transition meeting on September 14, 2016 at the offices of Brown and Streza in Irvine, California. She was asked to tell the story of how her career started and how she has transitioned through different phases to become the successful financial advisor she is today. This speaking engagement allowed Sandy to share her best practices, help, mentor and inspire other members to grow to new heights.

We’ve all gotten them, those privacy notices from your financial institutions that you get in the mail or receive electronically. Usually they are mailed out once a year or you receive one when you open a new account. Let’s be honest, most of us do not take the time to actually read them and they end up being filed away and forgotten about. Well we recently came across an article on My Money Blog that pointed out exactly what those companies are sharing about you and why it’s important for you to take the time to opt-out if you do not want your personal information shared with other companies.

Here is an example of a privacy notice:

The information that they share includes:

The amount of sharing varies widely:

Most of us are busy with our everyday lives and won’t take the time to opt-out and this is what the financial institutions are counting on. If you are tired of receiving unsolicited offers for credit cards or other services and are worried about your personal information being shared it only takes a small effort to contact your financial institution and opt-out. Most of these privacy notices can be found online when you log in to your account or you can call the company directly. Just imagine the amount of trees you will be saving when you stop getting 5 unwanted credit card offers in the mail a day. Not to mention the peace of mind you will have knowing that your information is not being sold.