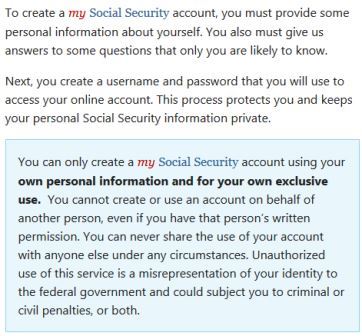

In an effort to go green, the Social Security Administration is now only mailing Social Security statements to workers 60 years old and over who are not receiving Social Security benefits. They do however offer a convenient online service that allows you to access your benefit information, earnings records and statements as well as complete a number of other services with the Social Security Administration. You will need to create a My Social Security Account to do so. I have included some instructions taken directly from their site to set up your account along with some detailed information on the benefits of using their online services.

Go to https://www.ssa.gov/myaccount

Click on Sign In or Create Account

What does a my Social Security account let me do?

If you do not receive benefits, you can:

Request a replacement Social Security card if you meet certain requirements;

Request a replacement Social Security card if you meet certain requirements; Check the status of your application or appeal.

Check the status of your application or appeal.- Get your Social Security Statement, to review:

- Estimates of your future retirement, disability, and survivors benefits;

- Your earnings once a year to verify the amounts that we posted are correct; and

- The estimated Social Security and Medicare taxes you’ve paid.

- Get a benefit verification letter stating that:

- You never received Social Security benefits, Supplemental Security Income (SSI) or Medicare; or

- You received benefits in the past, but do not currently receive them. (The letter will include the date your benefits stopped and how much you received that year.); or

- You applied for benefits but haven’t received an answer yet.

If you receive benefits or have Medicare, you can:

Request a replacement Social Security card if you meet certain requirements;

Request a replacement Social Security card if you meet certain requirements;- Get your benefit verification letter;

- Check your benefit and payment information and your earnings record;

- Change your address and phone number;

- Start or change direct deposit of your benefit payment;

- Get a replacement Medicare card; and

- Get a replacement SSA-1099 or SSA-1042S for tax season.

Thank you for Going Green!