The weather is getting warmer, it’s staying lighter later and there are tons of graduations happening. This can only mean one thing, summer is here. With the official start of summer being next week and this being the time that most people leave for vacation we thought it would be a great time to send a reminder about increasing your home security while you’re away. Unfortunately petty theft and home break-ins have been running rampant lately. Doing a little to protect yourself now can help you avoid this happening to you. Here are some reminders for when you’re away. (These tips can even help if you aren’t planning on taking a vacation)

- If possible, have someone stay in your home while away. This is the best option and gives you the peace of mind that your home and pets will be well taken care of.

- Make sure that the outside of your home is well lit, especially your porch and side yard/gate areas. Criminals are getting braver but most do not like to be conspicuous and bright lights may deter them.

- Put a stop on your mail and newspaper deliveries. Leaving these things to pile up is a sure sign that no one is home.

- Tell a trusted neighbor about your vacation and ask them to keep an eye out for any suspicious activity.

- Don’t post about your trip on social media. While it’s fun to share with your friends you never really know who is seeing the posts and it may alert the wrong people that you are away from your home.

- Install a security system. An alarm system or cameras are a great option to help deter criminals. A few of us in the office use the Ring doorbell that has a camera and is connected to Wi-Fi. It also has an intercom so if you are home and you receive a knock from an unwanted solicitor you can politely tell them no safely from inside your home.

With the BBQs, beach days, bike rides and bon fires, summer is one of my favorite seasons. Hope you all enjoy yours as much as I do!

Melani

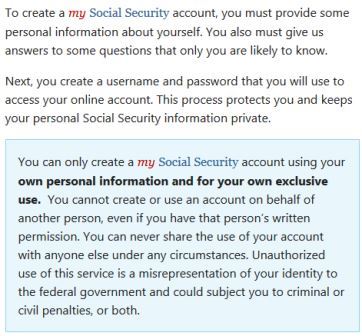

Request a replacement Social Security card if you meet

Request a replacement Social Security card if you meet